[4] Fieller's Theorem:

the "original" Wedge-Shaped ICE Confidence Region

Asymptotic Bivariate Normality of ICE Differences

Again, because ICE Inference is based upon sample mean values

in Cost and

Effectiveness measures, the (multivariate)

Central Limit Theorem clearly

applies, and the corresponding ICE Differences clearly tend towards having a

limiting Bivariate Normal Joint Distribution

under rather weak regularity conditions. Because this assumption of

normality is frequently quite realistic, it is extremely

natural to use the Fieller(1954) theorem

to develop confidence limits for the unknown, true ICE Ratio,

(CostDiff divided by EffeDiff).

Naturally, these intervals and the corresponding

BOW-TIE Shaped

confidence regions are very different

geometrically (and visually) from the much better-known,

elliptical regions needed to "cover" the unknown, true

ICE Outcome

PAIR, (EffeDiff,

CostDiff) with stated

confidence!

Application of Fieller's Theorem in

ICE Inference

Chaudhary and Stearns (1996) is an important

publication in ICE literature primarily because they displayed a closed-form

expression for computing the

Fieller Confidence Interval ...and its corresponding

BOW-TIE Shaped, bivariate confidence region. Earlier

papers by

O’Brien, Willan and others

had explored various, simple Taylor’s series expansion approximations.

Practical Problems in

interpreting Confidence Intervals (Regions) from Fieller's Theorem

[a] Small Numerical Differences really are Rather

Un-Important!

Consider the following numerical example:

Fieller’s Theorem 95%

Interval: -1.7652, +0.3463

ICE Angle Order Statistic

95% Interval: -1.7834, +0.3737

When "too many" decimal places are reported (as in the above

numerical listings), the Fieller Interval may

appear to be "different" from that of the corresponding Bootstrap

ICE Angle Interval. However, the graphical display below of the

corresponding 2-dimensional Confidence Regions

clearly shows that the Fieller and Bootstrap approaches

can be essentially equivalent in many cases...

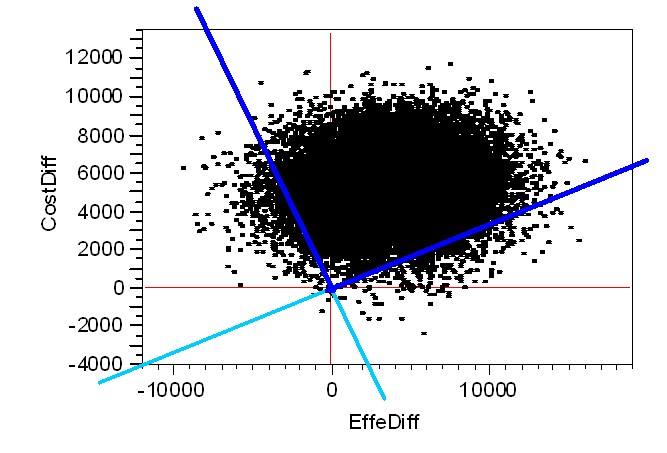

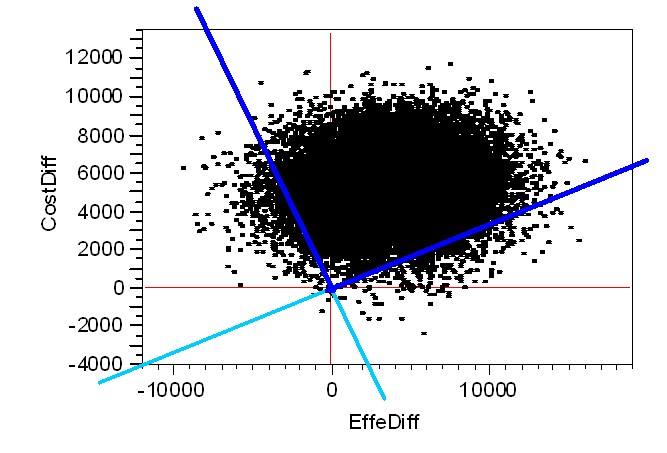

[b] Problematic "BOW-TIE" Shape:

Which "Half" should be

Thrown Away?

In the above graphic, the "top half" of the

Fieller BOW-TIE (that spans parts of the North-West and North-East ICE

Quadrants) is clearly the part to "keep." After all, this

particular "wedge" contains not only the ICE Outcome Pair, (+1,900, +5,289), of Observed

(Effectiveness, Cost) Differences but also roughly 95% of the Bootstrap

Re-sampled Outcomes! The "bottom half" (that

spans parts of the South-West and South-East ICE Quadrants) has the same

(finite, polar angular) size but contains almost no

Bootstrap Re-sampled Outcomes. And the two remaining wedges each contains

only roughly 2.5% of the Bootstrap Re-sampled Outcomes.

In summary, it usually is rather easy to decide which parts of the

Fieller BOW-TIE to throw away and ,thus, which

single

WEDGE to KEEP!

Still this sort of additional processing is a (mild) hassle

in the sense that it always needs to be done!

[c] "Infinite Intervals" can Result!

In fact, this phenomenon occurred in the above

example! The Fieller Interval (as well as the corresponding ICE

Angle Interval) contain all ICE Rays with Negative Slopes in the North-West

Quadrant that are numerically smaller (more negative) than roughly -1.77 as well as all

ICE Rays with Positive Slopes in the North-East Quadrant that are numerically larger

(more positive) than roughly +0.35. In other words, both the

Fieller and Bootstrap

intervals for this example can be described as consisting of the half-open interval (minus

infinity, -1.77] plus the half-open interval

[+0.35, plus infinity) ...with both parts being infinite

in length!

I really do not know why several ICE Confidence Interval

"critics" have tried to make such a BIG DEAL out of

this phenomenon. The reality is that ICE Ratios (Slopes) have a

simple discontinuity along the Vertical (EffeDiff=0) Axis

...where they suddenly jump between plus infinity and minus infinity.

My advise is this: Do not freak-out novices by reporting

these sorts of Intervals numerically; again, simply display the corresponding

Confidence Region graphically!

[d] Fieller's Theorem "Explodes" in High Uncertainty Cases!

Oh, Oh! This really is a MAJOR

SHORTCOMING. In fact, this is the ONLY REASON why the

Bootstrap Re-sampling approach using ICE Angle

Order Statistics should be considered to be more stable, robust and realistic than

the Fieller's Theorem approach!

By the way, it's rather obvious what goes "WRONG" with the

Fieller BOW-TIE in these "high uncertainty" cases. Each of the

opposing wedge-shaped "halves" of the BOW-TIE are

of the same (angular) size, so neither half can be wider

than 180-degrees!!! Thus, as the ICE Radius of the center-point of

the Bootstrap Re-sampling scatter decreases and the scatter approaches (and its

Convex-Hull ultimately covers) the ICE Origin, (0, 0), the

Fieller BOW-TIE WIDENS and eventually

attempts to COVER the entire ICE Plane.

Technically, the quantity within the square-root in the closed-form expression

of

Chaudhary and Stearns (1996) then becomes

NEGATIVE, and the only corresponding "solutions" for Fieller Confidence Limits become IMAGINARY!

In stark contrast, this sort of "explosion" simply cannot happen in the

Bootstrap Re-sampling approach using

ICE Angle Order Statistics because the

Central Polar Angle of the Bootstrap Wedge can easily exceed

180-degrees! In fact, the example wedge displayed on our

very first ICE Tutorial Page had a

Central Polar Angle spanning 237-degrees (i.e.

considerably more

than HALF of the full Bootstrap Re-sampling "PIE.")

Misconceptions that have lead to

Highly Questionable Simulation

Results

[a] Meaningless "Order Statistics" can result from

sorting ICE

Ratios instead of ICE Angles

The following is a computational "blunder" that I have seen

being repeated over and over again (in both ICE applications and ICE simulation

studies.) It's simply not appropriate (and

can be incredibly misleading and biased) to

(i) calculate the ICE Ratio for each Bootstrap Re-sample Outcome, to then (ii) sort these

values from numerically largest (most positive) to numerically smallest (most

negative), and finally (iii) to form a 95% Interval by "Counting Inwards"

2.5% of these ICE Ratio Order Statistics from each supposed "end" of the

resulting distribution.

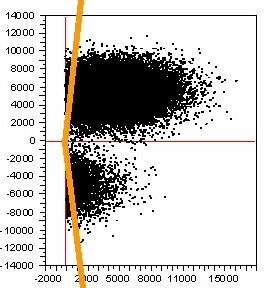

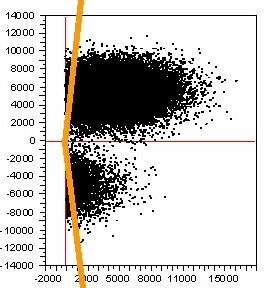

This faulty algorithm essentially makes the incredibly

naive assumption, (depicted visually below) that all Bootstrap Re-sampled

Outcomes always have an observed

EffeDiff that is non-negative!

LOOK how "distorted" and "disjointed" the actual Bootstrap Distribution

(depicted above) becomes due to this blunder ...and how

LARGE and incredibly BIASED this blunder can make the resulting ICE Ratio

confidence wedge!!!

ICE Ratio Order Statistic

Interval: +12.4343, -12.458

In my opinion, all published simulation studies that claim that

bootstrap ICE intervals are "biased" (or have

"inferior" coverage) relative to Fieller ICE intervals

make this same, incredibly naive computational mistake.

[b] The ICE Ray with the Most Positive ICE Slope does not

necessarily correspond to the Upper (Counter-Clockwise) Confidence Limit

We also saw this phenomenon in the above numerical

example! The correct Counter-Clockwise (Upper) Confidence Limit was

the negative value (of -1.77 or -1.78 within the SW Quadrant) rather than the

positive value (of +0.35 or +0.37 within the NE Quadrant.)

[c] Incorrect or Misinterpreted Trignometric Formulas

I think that the simulation

results reported in Cook and Heyse (2000) are credible; anyway, they do agree

with what I have found in my own ICE experience. On the other hand, one of

their formulas does not give correct answers in any computing environment that I

have tried it in:

Theta (degrees) = 180*atan(DelCost/DelEffe)/pi

+ 180 when DelCost is negative

Unfortunately,

Fan and Zhou (2007) apparently

trusted this formula and (not surprisingly) got simulation results that conflict

with those of Cook and Heyse (2000)!!!

The following alternative formula gives correct answers in the "R"

environment:

Theta (degrees) = 180*atan(DelCost/DelEffe)/pi

+ 180 when DelCost is negative

+ 180 when DelEffe * DelCost is negative

The JMP (from SAS) environment returns a "missing value" when asked to

compute atan(1/0) and atan(-1/0).

WARNING: Obenchain manuscripts

emphasize the ICE Preference Symmetry Axiom and, thus, place the ICE Angle

Origin (Theta = 0) along the x = -y diagonal within the SE ICE Quadrant.

Correspondingly, I also restrict attention to the finite ICE Angle range of

(-180, +180] degrees. Cook and Heyse (2000) place their Theta origin at my

Theta = +45 degrees. Furthermore, they essentially use the "positive"

Theta range of [0, 360) degrees.

Summary

ICE Inference practitioners really do need to be

discouraged from using computing algorithms that have

not been validated.

If nothing else, a suite of benchmark numerical examples and corresponding

"correct" analyzes needs to be established to speed testing of all

new/alternative algorithms.

Furthermore, consensus on what (objectively) really are the relative strengths and weaknesses

of alternative ICE methodologies is quite badly needed. My very first ICE

communication (1997) called for collaboration on these vital sorts of "issues and

algorithms."

References:

Fieller EC. Some problems in interval

estimation. J R Stat Soc B 1954;

16, 175-183.

O’Brien BJ, Drummond MF, Labelle RJ, Willan A.

In search of power and significance: issues in the design and analysis of

stochastic cost-effectiveness studies in health care. Med Care

1994; 32:

150-163.

Willan AR, O'Brien BJ. Confidence intervals for

cost-effectiveness ratios: an application of Fieller's theorem. Health

Economics 1996; 5:297-305.

Stinnett AA. Adjusting for bias in C=E ratio

estimates. Health Economics 1996; 5:470-472.

Chaudhary MA, Stearns SC. Estimating confidence

intervals for cost-effectiveness ratios: an example from a randomized trial.

Stat Med 1996; 15: 1447-1458.

Laska EM, Meisner M, Siegel C. Statistical inference

for cost-effectiveness ratios. Health

Economics 1997; 6: 229-242.

Polsky D, Glick HA, Willke R, Schulman K.

Confidence intervals for cost-effectiveness ratios: a comparison of four

methods. Health Economics 1997;

6: 243-252.

Tambour M, Zethraeus N. Bootstrap confidence intervals for

cost-effectiveness ratios: some simulation results. Health Economics

1998; 7:143-147.

Briggs AH, Fenn

P. Confidence intervals or surfaces? Uncertainty on the cost-effectiveness

plane (Student Corner.) Health Economics 1998; 7: 723-740.

Briggs AH, Mooney CZ, Wonderling DE.

Constructing confidence intervals for cost-effectiveness ratios: an evaluation

of parametric and non-parametric techniques using Monte Carlo simulation.

Stat Med 1999; 18:

3245-3262.

Cook JR, Heyse JF.

Use of an angular transformation

for ratio estimation in cost-effectiveness analysis. Stat Med

2000; 19: 2989-3003.

Jiang G, Wu J, Williams GR. Fieller’s

interval and the bootstrap-fieller interval for the incremental

cost-effectiveness ratio. Health Serv Outcomes Res Method

2000; 1:

291-303.

Fan MY, Zhou XH. A simulation study to compare

methods for constructing confidence intervals

for the incremental cost-effectiveness ratio. Health Serv Outcomes Res

Method 2007; 7: 57-77.